Investment Management

First and foremost, we believe that all investment recommendations should tie back to your personal financial plan. Once we understand your goals and the role your investments will play in achieving them, we can then make personalized portfolio recommendations. We also take into consideration your ability and willingness to take risk, your tax situation, and personal investment beliefs.

Our portfolio recommendations are based on the following principles:

1. Portfolio risk should match your tolerance.

Often called "Asset Allocation," this refers to a portfolio's balance between equity investments (stocks) and fixed income (bonds and CDs). Each person's allocation should be based on their ability, willingness, and need to take risk. It is common for your tolerance for risk and asset allocation to change over time, particularly as you near major goals (such as retirement) or if your situation changes. For this reason, portfolio risk should be reviewed regularly.

2. Decisions should be based on academic research.

We believe in letting decades of unbiased, peer-reviewed financial research guide our investment recommendations. We don't believe in reacting to media speculation or chasing returns.

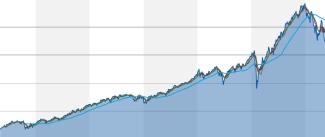

3. We cannot control or outguess the stock market.

It is extremely difficult to reliably and consistently, over a long period of time, accurately forecast the stock market’s direction, the movement of a specific stock, or the next economic shift. However, the stock market rewards long-term investors, so we focus on maintaining a disciplined investment approach. We do not try to time the market.

4. Diversification improves investment outcomes.

As no one knows exactly which stock, country or asset class will outperform in any given time period, we recommend a broadly diversified global stock portfolio. By holding a variety of assets, investors are well positioned to seek returns wherever they occur. it also reduces the impact on the portfolio if a single company, sector, or country has a bad year.

5. Taxes and costs should be controlled.

Taxes should be managed to reduce their drag on a portfolio. We practice asset location and tax management strategies, meaning that different accounts should be managed differently based on their tax status (for instance, pre-tax, taxable, or Roth). Investment fees matter - we are transparent with our fees and those of any underlying investment we propose, and strive to offer cost-effective portfolio options.