Is This a Good Time to Invest? (And How Does the Stock Market Work, Anyway?)

If you're reading this, you're probably aware that the stock market is down this year. A lot. We officially entered a "Bear Market" in June 2022, which means that the market in question (typically, the S&P 500 Index) has fallen more than 20% from its most recent high. Although we saw a late-summer rally, another plunge in September still places us in bear market territory.

However, what does that all mean, and how should you think about your own investments? Let's break it down.

First, some Stock Market 101.

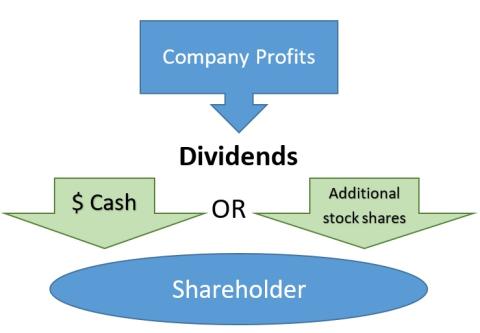

When we buy a public company stock, we become a Shareholder (or stockholder) - a partial owner of that company, along with all the other Shareholders. We purchase a stock because we believe that the company will be profitable, and that owning the stock will be profitable for us, too. Shareholders can make money in two ways:

- When a company is profitable, it may pay some of these profits out to its shareholders in the form of Dividends. Smaller companies in growth mode may choose not pay dividends, instead using any profits to invest in additional growth. However, large companies will often pay dividends to their shareholders each year.

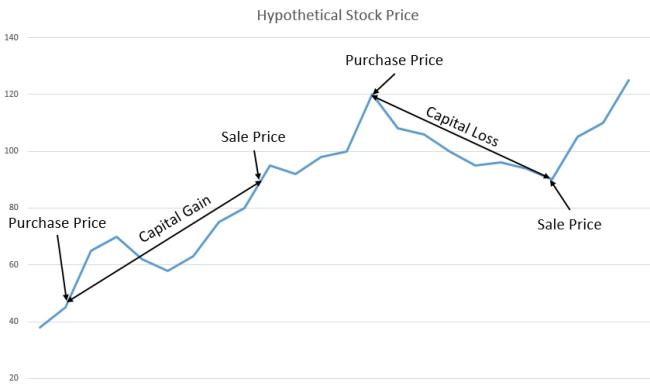

- When we sell a stock for more than we paid for it, we made a profit called Capital Gains.

Let's talk about Dividends.

Dividends are paid to shareholders while they own the stock, so it's the first way that shareholders can make money. When companies earn a profit, they typically pay a portion of this to their investors. Often, they will also keep some of the profits within the company, to re-invest in company growth, pay down debt, or establish cash reserves.

Investors then have the choice to receive their dividends as a cash payment, or to re-invest it in additional company stock. For most investors who don't need regular income from the portfolio, reinvestment is the default. So instead of receiving a dividend check for, say, $100, the shareholder would instead receive $100 more stock from the company. By then owning more stock, you'd receive a larger dividend payment the next time, and so on, leading to compound growth. For this reason, reinvesting dividends is often the recommended option. Earlier this month, CNBC reported that reinvested dividends accounted for 68% of the S&P 500's total performance since 19881.

What about Capital Gains?

If a stock isn't paying a large (or any) dividend, investors are relying more on capital gains - that they'll be able to sell the stock for more in the future. If you purchase a stock for $100, and sell it for $200, then you have made a $100 profit - or Capital Gain.

A company's stock price moves day to day as people and corporations buy and sell the stock. The price is a measurement of how investors feel about the company's future earning capabilities. A drop in price means that investors are no longer quite so optimistic about the company's future prospects, and so are not willing to pay so much for their stock anymore. Alternatively, a rise comes when investors feel good about future earnings - such as when a new product is announced that shareholders believe will lead to greater profits. These price changes can be based on information particular to the company in question, or based on broader economic conditions that will affect many companies at once.

For example: take Apple (ticker APPL)

Let's look at Apple stock, which currently has the largest stock market capitalization in the world (the total value of all outstanding stocks). On Monday, January 3rd 2022, APPL was selling for $182.01 per share. However, in 2021, Apple had paid dividends of just 87 cents per share2. This means that if dividends and share price did not change, it would take an investor over 209 years to get their $182.01 back in dividends. Doesn't seem like a good investment!

However, investors paying this price were betting that Apple would continue to grow and become more profitable over time. A willingness to pay $182.01 per share means that investors believed that:

- Apple's profitability would continue to increase, and they would raise dividends in the future

- This increase in profitability would also increase the stock price, and the investor can sell the share for more than $182.01 someday.

Instead, what has happened this year? Although Apple's dividend has increased slightly (they paid 23 cents per share in August 2022, compared to 22 cents per share in August 2021), the threat of a global recession has caused Apple's stock price to drop to $151.11 (as of mid-day 9-26-22). A recession could damage Apple's product sales and profitability, while rising interest rates will make it more expensive for Apple to borrow money. Many of Apple's products are discretionary (non-essential), so if people are tight for cash, they may not buy the newest iPhone or Apple Watch.

Does this mean that Apple is a bad stock to own? Not necessarily. Over the past 12 months, the price has still increased from $145 to $151 - so despite the drop this year, someone who invested 12 months ago has still made money. Over a longer period, Apple has grown from just $38.28 per share over the past 5 years (9-26-173). Given Apple's status as a leader in technology, it is likely in a good position to weather a recession and rebound afterward. And, for those who already own the stock and have not sold it this year, their loss is only on paper - they still own the exact same share they owned on January 3rd. In fact, if they've reinvested this year's dividends, they may actually hold more shares. If they continue to hold the stock and are able to sell in the future for more than $182, they will still have made a profit.

That's individual stocks. How does the stock market work?

It's important to really understand what the stock market measures. While most people understand that it's an indicator of the broader economy, they may not understand what it's actually tracking.

The "stock market" is measured by a number of different indexes, which contain and track different stocks within them. The primary three US stock indexes are:

- The S&P 500. Many people refer to the S&P 500 Index as "the market," though in actuality the S&P 500 Index is only measuring the stock prices of the largest 500 companies in America.

- The Dow Jones Industrial Average, which tracks just 30 stocks that Dow Jones feels are indicative of the broader market.

- The NASDAQ Composite is another market index that is commonly cited, although the NASDAQ contains more technology stock than the other two and so can have significantly different outcomes in any given year.

As mentioned, the S&P 500 Index is only the largest 500 public companies in the US. However, that still leaves many smaller public companies that aren't measured in this index. Yet another measurement, the Dow Jones U.S. Total Stock Market Index, includes 4,222 companies as of August 31, 20224.

Regardless of which index you use to measure "the market," the stock market is tracking how the stock price of its different components (companies) are moving. If a given index is down for a time period, that means that on average, the stock prices of the companies within that index have been dropping. Going back to Apple: on 8-12-22, Barron's reported that Apple made up 7.3% of the S&P 500 Index5. Despite being one out of 500 stocks (which would be .2%), Apple's size gives it a disproportionate impact on the index. As of September 26th, Apple's stock price had fallen 17% in 2022, contributing to the S&P 500's drop6.

So, if the stock market is falling, that means the value of company stocks are going down (on average). Note: this only applies to publicly-traded companies, whose shares trade on stock markets like the New York Stock Exchange. Privately-held companies, which can make up a large part of the local economy, are not reflected in the stock market. There are also various other stock markets around the world that include many international companies.

So tell me again what a "bear market" means?

The S&P 500, as well as the NASDAQ Composite, have fallen more than 20% since the beginning of the year (as of 9-28, the Dow Jones has performed slightly better and is only -18.31% for the year). This means that the stock prices of many of their companies have dropped by 20% or more. This is due to a number of factors:

- The Federal Reserve has been rapidly increasing interest rates to try to tamp down inflation. For companies that borrow money routinely as part of their business, they will now pay more interest, which could eat into profits.

- Individuals are shifting their buying habits, as more of their income is going towards energy, groceries, and other necessities. Companies that sell non-essential items may see significant declines in sales and profits.

- The war in Ukraine is having global effects. Companies are increasingly globalized - although they may have headquarters in the US, they are dependent on materials, production, and sales in other countries. As energy prices spike in Europe and around the globe, it may cost companies more to produce their goods, while at the same time cutting international demand as well.

- Individuals worried about a market drop may create a self-fulfilling prophecy. As investors rush to sell their stock, the increase in supply (compared to demand for the stock) lowers the price - therefore causing other investors to panic and sell their stock - lowering the price further - etc.

If you've seen your investments decline this year, we understand that it may be troubling. However, if you haven't sold your stock, then you still own the same shares that you did earlier this year - it's just their current value that has declined. If your portfolio is properly diversified across different companies and sectors, sometimes the best advice is to hold on and wait for the economy, and the share prices, to recover.

What are the risks?

Investing in the stock market always comes with risk. Over the history of the stock market, investors have been rewarded for taking this risk through higher returns. If the stock market didn't have any benefits above safer investments, such as government bonds, people would have no incentive to take the risk. Therefore, companies are motivated to act in the best interest of their shareholders and reward them for taking on the risk of investing in their company.

However, as we've seen this year, the stock market doesn't always go up. There are a few key considerations when starting an investment:

- How long do I have to invest? Can I wait out a market decline, or could I be forced to sell at a market bottom because I need the money?

- Am I willing to take some risk, or will I lose sleep at night if my investments decline?

- Am I well-diversified across different company stocks?

We stress diversification because it reduces the risk of a single company having a great impact on your investments. Sometimes people ask, "Can I lose everything I invest?" Investing in a small number of companies increases your risk and reliance on those companies alone. If a company goes bankrupt and closes, their stocks could become worthless and you would have lost your investment. Therefore, we recommend investing in a well-diversified portfolio that contains the stock of hundreds (even thousands) of companies, which reduces the risk that a single bad company could ruin your portfolio.

So, is this a good time to invest?

For individuals who have a long time frame to invest, a market downturn could actually present a great buying opportunity. Lower share prices mean that you can purchase more shares than you could earlier this year, and a portfolio that's diversified across companies and even across various countries could be well-positioned for growth once economies around the world recover. However, we never know where the market bottom was until it's long past, or how long a downturn or recession may last. It's possible that stock prices could drop further before they get better, so it should be stressed that any investment should be viewed as a long-term commitment. Alternatively, we could be near the bottom today, and we could see prices recover in the coming months and years. But if you have the ability to save and invest additional funds for the future, this could be a great time to add some funds and ride the eventual recovery back up - whether that's in 1 year, or takes 3 years or more.

Have questions or want to see different topics in future articles? Contact us.

This article is meant for educational purposes only and is not meant as a specific recommendation. If you have questions, please contact us to schedule an appointment to discuss your own investment situation, time frame, and willingness to take risk. If you have suggestions for future articles, please let us know - we appreciate your feedback!

1. https://www.cnbc.com/2022/09/09/how-dividends-work-add-to-stock-returns-chief-investment-strategist.html

2. https://www.nasdaq.com/market-activity/stocks/aapl/dividend-history

3. https://finance.yahoo.com/quote/AAPL/history?period1=1506038400&period2=1506556800&interval=1d&filter=history&frequency=1d&includeAdjustedClose=true

4. https://www.spglobal.com/spdji/en/indices/equity/dow-jones-us-total-stock-market-index/#overview

5. https://www.barrons.com/articles/oil-prices-today-51663920272

6. https://www.google.com/searchq=aapl+ytd&rlz=1C1GCEU_enUS884US884&oq=AAPL+ytd&aqs=chrome.0.0i131i433i512j0i512j0i22i30l2j0i390l2.2832j0j4&sourceid=chrome&ie=UTF-8