Coping with Market Volatility

You've probably heard the stock market compared to a roller coaster, with its ups and downs. The primary difference, though, is that a roller coaster ends in the same spot, whereas the stock market has historically gone up more than it as gone down. However, it can be difficult to remember that when it's fluctuating day-to-day. How should you cope with the changes?

Keep your long-term goals in mind

When you first invested your funds, you (perhaps in conjunction with your financial advisor) likely considered your ability to take market risk. You likely thought about questions such as:

- How soon will I need the money? Do I have time to ride out any market downturns?

- How will I feel about a market decline? Will I lose sleep if my investments lose money?

- How much risk do I need to take to meet my goals?

If you accurately assessed your tolerance for market risk at that time, then hopefully the current downturn does not come as a surprise. While it can still be disappointing to open financial statements and see that the balances have declined, it's expected that any investment in the stock market will have some periods of negative performance. Keeping your long-term goals in mind, you should continue on your path and re-assess your risk tolerance as you get closer to your goals, or after major life events.

If this market downturn is causing you to lose sleep at night, then your portfolio should be re-examined. Perhaps you're closer to your goals, or you don't have the tolerance that you thought you did, now that you're actually seeing a decline. You should speak with your financial advisor to determine if a change should be made, and if so, at what time.

Avoid emotional investment decisions

It can be tempting, if you see your account value declining, to sell your investments to avoid further loss. However, that may just lock in your losses and cause you to miss out on the market recovery that does (eventually) follow. Remember, a well-diversified portfolio holds shares of hundreds, or even thousands, of companies - many of whom will make it through a market downturn or recession. Selling an investment today assures that you're selling at today's depressed price, rather than allowing the company (and stock price) to recover.

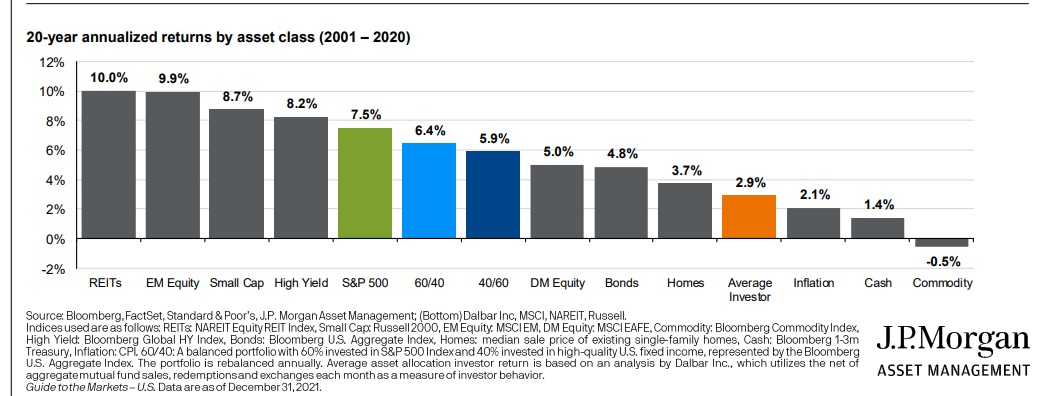

Investors may feel that it's wise to sell when the market is falling, with the hopes of avoiding further loss and reinvesting at the bottom. However, investors are historically bad at timing the market; only in hindsight do we find out where the bottom was. By the time it's evident, we may have already missed out on a substantial part of the subsequent recovery. This is why, according to JP Morgan, the average investor has only had an average return of 2.9%, compared to a 7.5% return of the S&P 500 or a 6.4% return of a 60/40 stock and bond portfolio (for years 2001-2020, JP Morgan Guide to the Markets 12-31-2021).

Re-evaluate your financial plan

Your financial plan should always account for the possibility of a market correction or period of volatility. However, this would be a good time to run a new analysis and re-evaluate your plan. Perhaps you find that some changes need to be made, such as guaranteeing some level of retirement income to help you feel more confident in your plan. Alternatively, maybe you find that your plan is still on track despite the downturn, which helps you sleep better at night. In any case, a careful evaluation will help you make decisions based on analysis, rather than emotions.

Have questions? Contact us using the form below to schedule a consultation.

This content is developed from sources believed to be providing accurate information. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets.

When you click on any of the links provided in this article, you are leaving this website and viewing information provided by a third party. The information being provided is strictly as a courtesy. When you click on any of the links provided within these articles, you are leaving this website and viewing information provided by a third party. We make no representation as to the completeness or accuracy of information provided by any third-party website. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information, and programs made available through this website. By accessing these websites, you assume total responsibility and risk for your use of the third-party website.